The situation in China – a chance for active managers to earn their fee?

One of the endless debates in the world of investing, is whether active or passive is better.

Active managers claim to be able to “beat the market”. That is that when the market (or their chosen benchmark) rises their fund will rise more, and when it falls their fund will fall less.

Advocates of passive investment say that this is not consistently possible and so there is no point in paying for active management. Instead investors should opt for a passive fund which simply tracks the performance of a market index or benchmark.

Increasingly the passive argument appears to be more valid. Very few managers can consistently beat their benchmark or index. Though there is also a valid counter argument that were it not for active investors, passive funds would not perform at all!

Our view is that there is a place for both strategies in a portfolio. In general, we believe that the further West one invests, the weaker the active argument is. If you were looking to invest in America, then an S&P500 ETF may very well be the best option. Conversely the further East you look, the case for passive investment may appear more risky.

Asian markets are generally less mature and corporate governance is often held to a different standard than in the West. As such, “price discovery” is less simple. There is also far more political risk to be taken into account. Recent events in China have brought this to the fore.

Investors in Western markets do not have to contend with events such as the sudden disappearance of Jack Ma or the sanctioning of Tencent due to the distinction between gaming and gambling being somewhat unclear.

More recently there has been the impact of President Xi’s “Zero COVID” policy. with long-running lockdowns of mega cities such as Shanghai. Many had expected this policy to be relaxed once Xi had been formally made president for an almost unprecedented third term, at the party Congress in October this year. While Xi made no mention of any change, after the Congress had finished rumours circulated of a subtle relaxation being implemented. The market duly soared.

However the vaccination rates in China are low (particularly among the elderly, who are must susceptible to the disease) and the domestic vaccine appears to be far less effective than the Western versions. So when a loosening last month led to a huge rise in cases, further lockdowns were announced. The ensuing protests against Xi and the Chinese Communist Party have not been seen since the Tiananmen Square massacre in 1989.

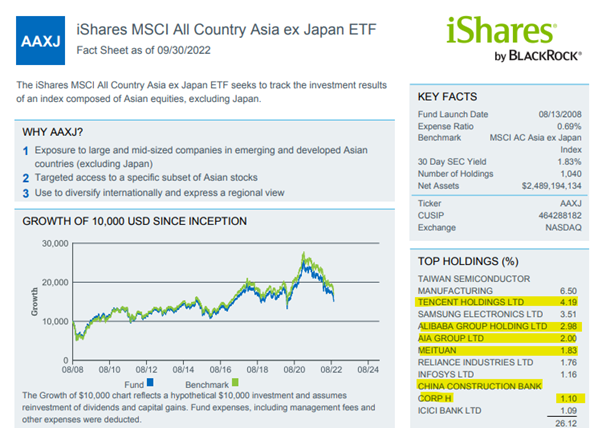

These are now truly dangerous and uncertain times for China and it’s population. Investors hate uncertainty. You would therefore expect an Asian fund manager to be reducing their exposure to China. An investor in an ETF has no such option. The holdings in an ETF are determined by the relative value of the companies in the index. Alibaba makes up almost 3% of the the Asia excluding Japan index, and so an ETF must invest three percent of its money in that company. The prospects of the company and the political risk affecting it can never be taken into account.

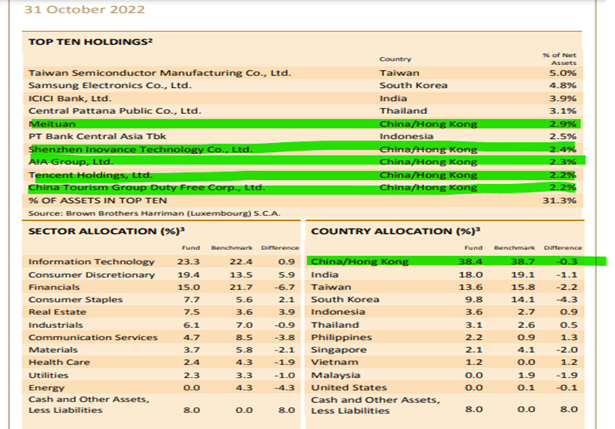

Interestingly, as at the end of October at least, one excellent Asian manager (Matthews Asia) had a very similar weighting to China as its benchmark:

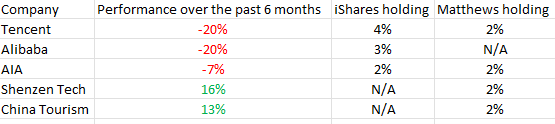

However, being able to chose which firms to invest in has led to quite differing results for Matthews’ Chinese holdings:

With the turmoil of this year and now surely a lot more to come, this is a great chance for active managers to prove their worth. Those invested in the ETF will simply have to ride it out – as the likes of Tencent and Alibaba will remain among the most valuable companies in Asia and so continue to be major holdings in the ETF regardless.

It will be fascinating to see firstly how the Matthews portfolio has changed (this is reported quarterly, so we shall see at the end of this month), but also how the two fair over the coming months and years now.

As always, nothing contained here should be construed as advice. Anyone interested in discussing their investment portfolio should get in touch.