Timing the market, or time in the market?

After a largely profitable decade, the last two years have been rather disappointing for some investors.

The main reason for the market decline has been the impact of the sudden and rapid rise in interest rates, which affected the valuation of future company profits (on which professional investors often base their decisions).

What does this mean for investors?

You may find yourself with, for example, cash in a poorly performing portfolio while bank interest rates are showing a good return. Moving to a cash account may appear to be a rational response.

Why commit more cash and risk further disappointment?

If the market is heading flat to down, what’s the point when you can make a 5% return in your bank account?

Unfortunately, this is a classic example of human nature working against our best interests.

Saving a cent but missing the dollar

A falling market makes investment cheaper but once the market recovery is entrenched, and confidence returns, you’ve missed any bargains and you might well end up entering near the next peak.

Time and again surveys show that retail investors sell when things are bad (low) and buy when things are going well (high).

Buy-high-sell-low is not the way that you make a profit.

A recent Morningstar survey[i] calculated that retail investors missed out on over 20% of potential profit simply by trading in and out of a fund at the wrong times.

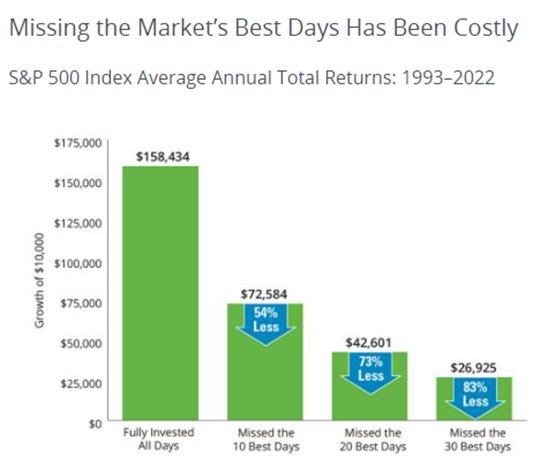

Another survey by Morningstar and Hartford Funds[ii] surveyed the effect of missing the best days in the market over a thirty-year period. The results are quite staggering:

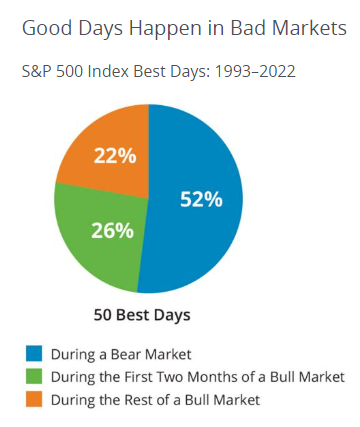

“Avoiding the market’s downs may mean missing out on the ups as well. 78% of the stock market’s best days occur during a bear market or during the first two months of a bull market. If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half.”

Miss just ten out of 10,950 days and your profit is more than halved!

Interestingly, many of the best days occur when the market’s general direction is down (referred to as being in a Bear market), as opposed to when it is rising (referred to as being in a Bull market):

You’ve got to be in it to win it

While we may be inclined to try and avoid the bad times while hoping to profit from the good, trying to time the market is truly a fool’s errand.

For those who really want to see a good return on their investment in the market the message is clear: you’ve got to be in it to win it.

[i] https://www.morningstar.com/funds/bad-timing-cost-investors-one-fifth-their-funds-returns

[ii] https://www.hartfordfunds.com/practice-management/client-conversations/managing-volatility/timing-the-market-is-impossible.html

[PS1]Can you get a clearer screenshot?